Procurement AI

An AI Powered Plug & Play Parts Procurement Platform for Airlines & MROs

Increase efficiency | Reduce cost | Enhance visibility | Power your team

Request a demoTrusted by

SkySelect is not your typical procurement platform, an exchange, marketplace, or listing service - it's so much more. SkySelect offers self-service software and full-service sourcing, procurement, and order tracking to supplement your operations.

Self-Service Software Platform

for end-to-end procurement automation

AI Sourcing & PO Optimization

for cost savings, lead-time reductions on C&E spend

Full-Service Procurement

to scale purchasing capacity to meet demand

2100+

tails supported

annually

2500+

active

suppliers

$3B+

sourced and

procured

200+

EDI, Spec2000

suppliers

M&E

system

integrations

MEASURABLE ROI

Take control of your material supply chain

SkySelect enables airlines and MROs to make the supply chain visible, boost cycle times, increase capacity, improve on-time delivery performance, unlock cost savings, and scale procurement to meet market requirements.

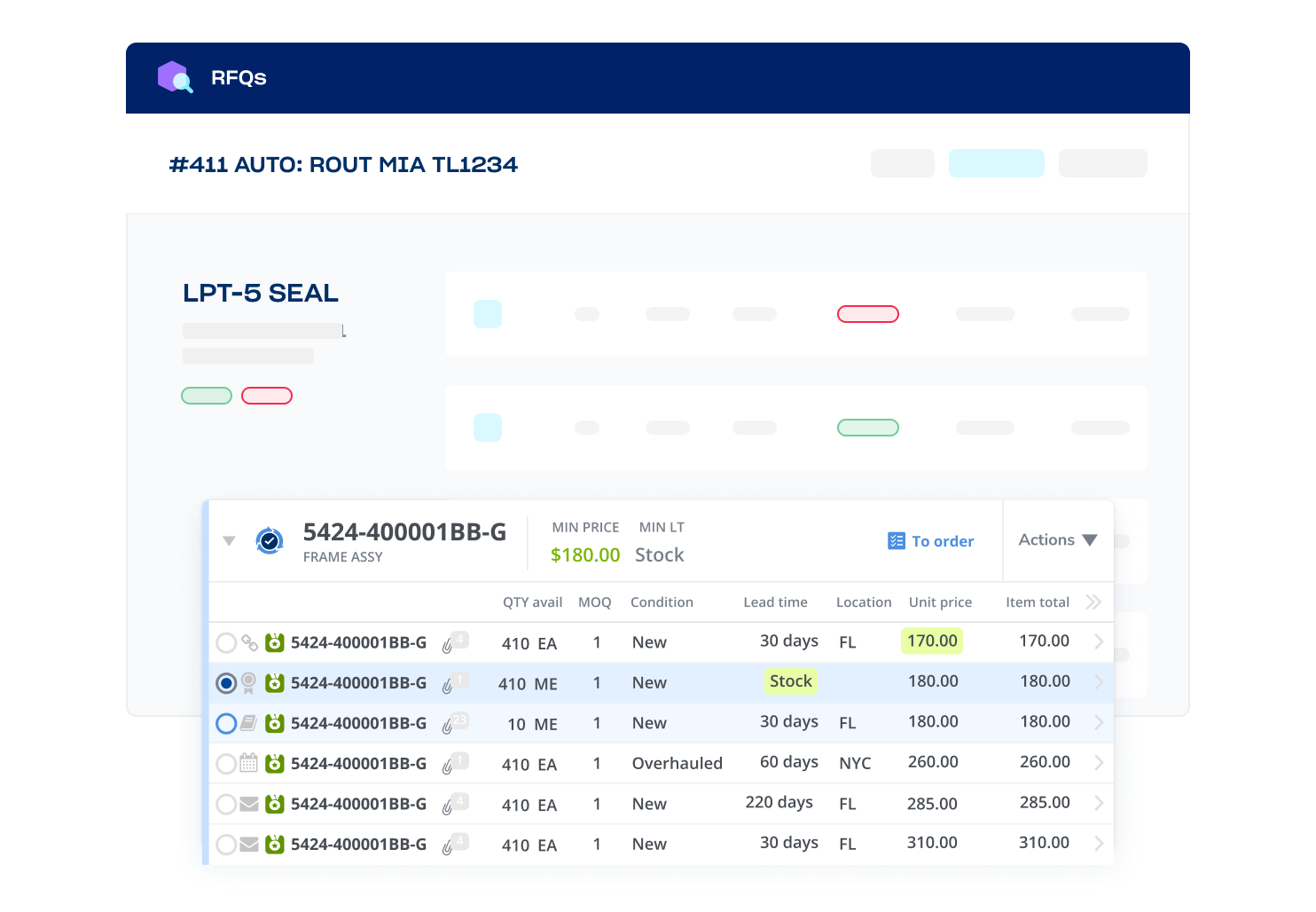

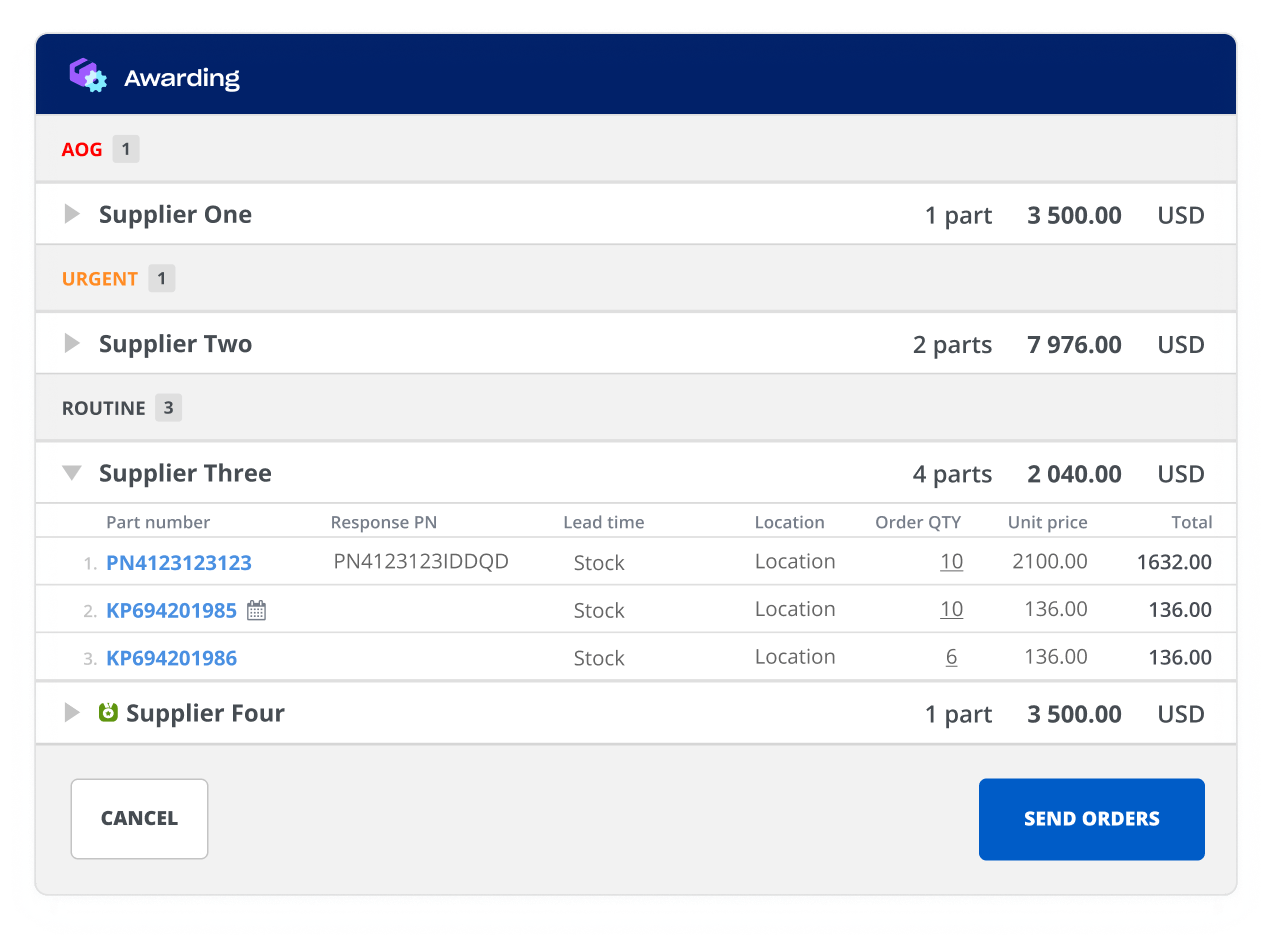

Autonomous Purchasing

by leveraging machines to get and track quotes

Cost Savings

on parts by getting more quotes and finding the best deals from the market

On-time Delivery Improvement

through proactive delay management

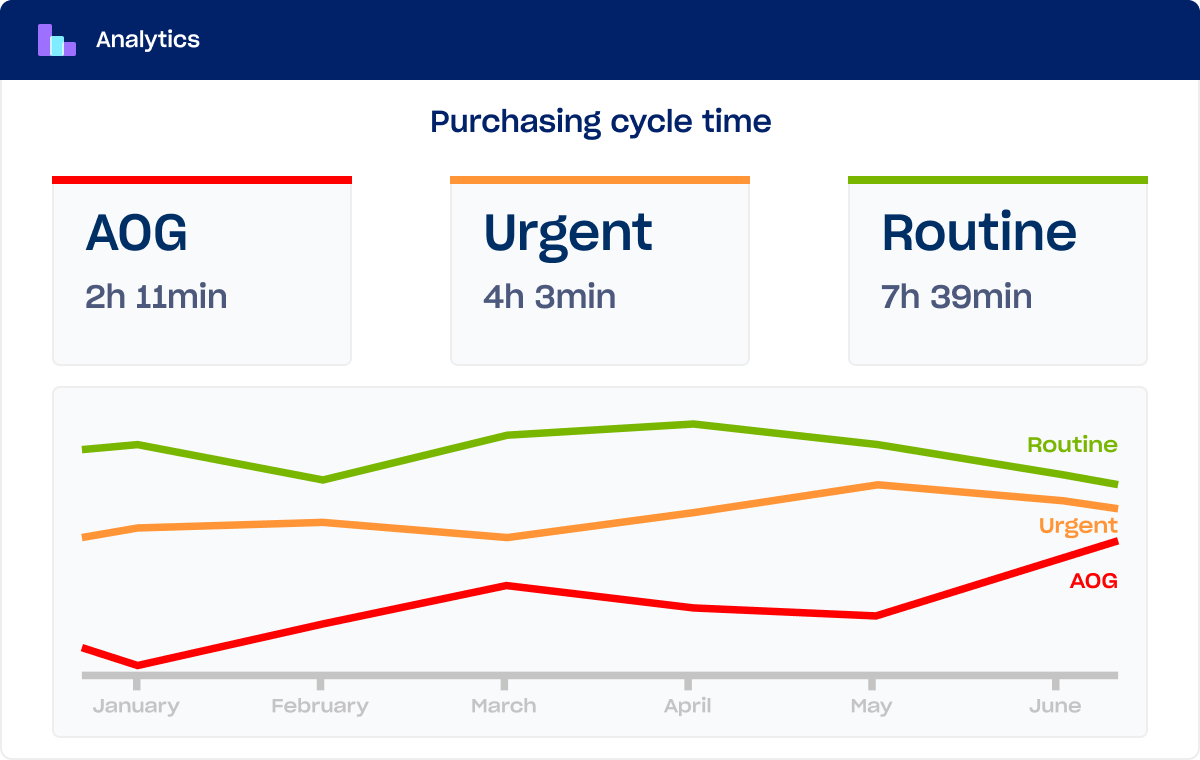

Faster Cycle Times

by slashing the time it takes from part request to a PO

with no IT required

More savings. Faster processing. Better visibility.

Get the best options on the market without adding more cost to your process

Know what to prioritize and focus on. Solve issues quickly to avoid any delays.

Full visibility to know what to prioritize and focus on. Solve exceptions quickly to avoid any delays.

Real-time analytics enable you to measure and improve your supply chain.